Content

If you don’t keep the improvements when you end the lease, figure your gain or loss based on your adjusted basis in the improvements at that time. If you sell at a loss merchandise and fixtures that you bought solely to get a lease, the loss is a cost of getting the lease. You must capitalize the loss and amortize it over the remaining term of the lease. The cost of getting an existing lease of tangible property is not subject to the amortization rules for section 197 intangibles discussed in chapter 8.

The IRS never sends email requesting that you obtain or access your transcripts. Report all unsolicited email claiming to be from the IRS or an IRS-related function to The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals.

Are prepaid expenses current or noncurrent assets

The value of the prepaid asset is offset by what the cost of the expense would be to each of the affected reporting periods. For this reason, a business must amortize, or calculate, the monthly cost for a prepaid expense. Then, when the expense is incurred, the prepaid expense account is reduced by the amount of the expense, and the expense is recognized on the company’s income statement in the period when it was incurred. With amortization, the amount of a common accrual, such as prepaid rent, is gradually reduced to zero, following what is known as an amortization schedule. The expense is then transferred to the profit and loss statement for the period during which the company uses up the accrual. Journal entries that recognize expenses related to previously recorded prepaids are called adjusting entries.

You can deduct the rent for 2023 and 2024 on your tax returns for those years. You generally cannot deduct or capitalize a business expense until economic performance occurs. If your expense is for property or services provided to you, or for your use of property, economic performance occurs as the property or services are provided, or the property is used. If your expense is for property or services you provide to others, economic performance occurs as you provide the property or services.

Prepaid Rent

If you reported the amount as wages, unemployment compensation, or other nonbusiness ordinary income, you may be able to deduct it as an other itemized deduction if the amount repaid is over $3,000. You must use a reader to do your work, both at and away from your place of work. You can deduct your expenses for the reader as a business expense. A kickback is a payment for referring a client, patient, or customer. The common kickback situation occurs when money or property is given to someone as payment for influencing a third party to purchase from, use the services of, or otherwise deal with the person who pays the kickback.

Go to IRS.gov/Notices to find additional information about responding to an IRS notice or letter. We will send you a notice or letter if any of the following apply. If you need a photocopy of your original return, complete and mail Form 4506, Request for Copy of Tax Return, available at IRS.gov/Pub/irs-pdf/F4506.pdf, along with the applicable fee.

Unearned revenue:

You borrowed $20,000 and used the proceeds of this loan to open a new savings account. When the account had earned interest of $867, you withdrew $20,000 for personal amortize prepaid expenses purposes. You can treat the withdrawal as coming first from the interest earned on the account, $867, and then from the loan proceeds, $19,133 ($20,000 − $867).

Startup costs include amounts paid or incurred in connection with an existing activity engaged in for profit, and for the production of income in anticipation of the activity becoming an active trade or business. For costs paid or incurred before October 23, 2004, you can elect to amortize business startup and organizational costs over an amortization period of 60 months or more. The costs of determining the existence, location, extent, or quality of any mineral deposit are ordinarily capital expenditures if the costs lead to the development of a mine. You recover these costs through depletion as the mineral is removed from the ground. However, you can elect to deduct domestic exploration costs paid or incurred before the beginning of the development stage of the mine (except those for oil and gas wells). The assessments for construction costs are not deductible as taxes or as business expenses, but are depreciable capital expenses.

You must get IRS approval to revoke your election to amortize qualifying reforestation costs. Your application to revoke the election must include your name, address, the years for which your election was in effect, and your reason for revoking it. Provide your daytime telephone number (optional), in case we need to contact you. If you are engaged in the trade or business of film production, you may be able to amortize the creative property costs for properties not set for production within 3 years of the first capitalized transaction. You may amortize these costs ratably over a 15-year period beginning on the first day of the second half of the tax year in which you properly write off the costs for financial accounting purposes. If, during the 15-year period, you dispose of the creative property rights, you must continue to amortize the costs over the remainder of the 15-year period.

She can claim a business bad debt deduction only for the amount she paid because her guarantee was made in the course of her trade or business for a good faith business purpose. She was motivated by the desire to retain one of her better clients and keep a sales outlet. Bonuses and advanced royalties are payments a lessee makes before production to a lessor for the grant of rights in a lease or for minerals, gas, or oil to be extracted from leased property.

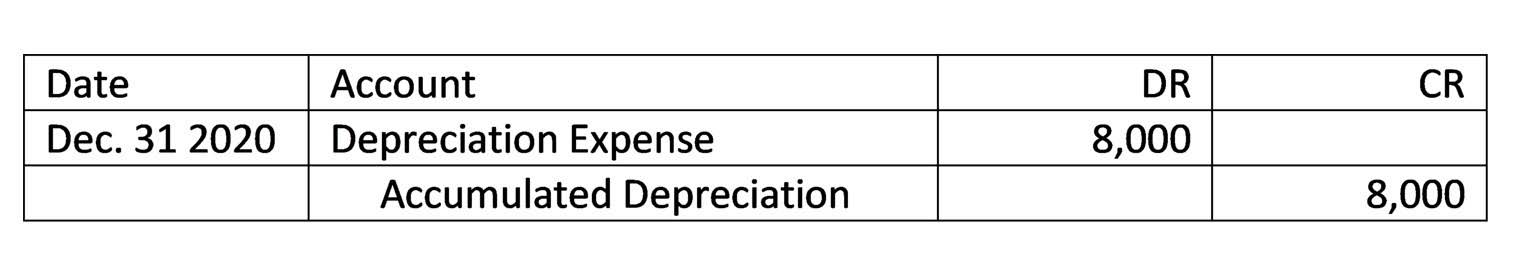

Recording Process

Property produced for you under a contract is treated as produced by you to the extent you make payments or otherwise incur costs in connection with the property. You may be subject to the uniform capitalization rules if you do any of the following, unless the property is produced for your use other than in a business or an activity carried https://www.bookstime.com/articles/in-kind-donations on for profit. The part that is for the increased rental value of the land is a cost of getting a lease, and you amortize it over the remaining term of the lease. You can depreciate the part that is for your investment in the improvements over the recovery period of the property as discussed earlier, without regard to the lease term.

Report the current year’s deduction for amortization that began in a prior year directly on the “Other deduction” or “Other expense” line of your return. No other depreciation or amortization deduction is allowed for costs of qualified film or television production or any qualified live theatrical production if an election is made to deduct such costs. A facility is all or any part of buildings, structures, equipment, roads, walks, parking lots, or similar real or personal property. If you retire and remove a depreciable asset in connection with the installation or production of a replacement asset, you can deduct the costs of removing the retired asset. However, if you replace a component (part) of a depreciable asset, capitalize the removal costs if the replacement is an improvement and deduct the costs if the replacement is a repair. Qualifying reforestation costs are the direct costs of planting or seeding for forestation or reforestation.