If you’re looking to add high quality dividend stocks to hedge against inflation, Forbes’ investment team has found 5 companies with strong fundamentals to keep growing when prices are surging. As the overall stock market remains choppy, plenty of investors may be considering which dividend stocks to buy for steady, reliable returns. In the near term, stocks offering average- to above-average yields can produce steady gains in a sideways market.

There’s little indication that TSN’s current dividend (3.07% forward yield) is under threat, given the stock’s low payout ratio of 27.72%. Not only that, food inflation appears to be in the process of normalizing. Like other regional bank stocks, FITB stock tanked when the crisis first took hold in mid-March.

Best Travel Insurance Companies

Unlike many of the best dividend stocks on this list, you won’t have a say in corporate matters with the publicly traded BF.B shares. Atmos clinched its 36th straight year of dividend growth in November 2022, when it announced an 8.8% increase to 74 cents a share per quarter. Defense contractor (opens in new tab) General Dynamics (GD (opens in new tab)) was added to the elite list of best dividend stocks for dividend growth in 2017. The expected rate of return shown in the last column is computed by taking the current dividend yield plus a return to fair value over the next 5 years and a discounted long-term earnings forecast.

This leads many investors to perceive dividend stocks as more stable and less likely to see sharp price decreases, even when the economy turns sour. Before investing your money, invest some time in looking for companies that are financially healthy enough to sustain and potentially grow their dividends, and continue to offer an attractive dividend yield. Dover last raised its payout in August 2022, when it upped the quarterly outlay by 1% to 50.5 cents per share. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable.

In 2019, the company spun off its jeans business to shareholders via the publicly traded Kontoor Brands (KTB (opens in new tab)). The following year VFC acquired streetwear brand Supreme, but also divested its occupational workwear brands and business. Formerly known as McGraw Hill Financial, S&P Global (SPGI (opens in new tab)) is the company behind S&P Global Ratings, S&P Global Market Intelligence and S&P Global Platts. Strong performance from actively managed funds and the firm’s focus on the growing retirement market are just two factors boosting AUM, analysts note.

Please keep in mind that this is a back-tested performance and not an actual one. Also, please note that one of the stocks, VICI, did not have sufficient history, so it could not be included prior to 2018. Finally, we will also remove some stocks to avoid any over-concentration from one sector or any one industry segment.

What Is the Dividend Yield?

Return on invested capital (ROIC) measures how well a company uses its resources to generate profits. The calculation is net operating profit after tax divided by invested capital, which is debt and equity plus any cash generated from financing and investing. KeyCorp (KEY) is a holding company for commercial and consumer financial institution KeyBank National.

ADP provides payroll, tax, and human resources services to large corporations and publishes a well-regarded monthly jobs report. The company pays an annual dividend of $5, which is a yield of 2.02%. The company’s return on equity is 30%, “significantly higher than the industry average,” and it has increased its dividend every year for the past three decades. Exxon also has a diversified portfolio of oil, gas, and other energy products, including significant investment in renewable energy sources. “Dividend payers can help beat the market in an inflationary environment in two ways,” says R. Burns McKinney, managing director and senior portfolio manager at NFJ Investment Group.

A high yield is just one of several aspects to consider when investing in dividend stocks. A higher-than-average yield can signal trouble if a struggling company is paying large dividend amounts in an effort to attract investors. Below, we look at the top five dividend stocks in the Russell 3000 Index by forward dividend yield, excluding companies with payout ratios that are either negative or in excess of 100%.

As you might guess, once a company achieves this milestone, the leadership team is not likely to let it go easily. You can also check a stock’s inclusion in quality-related indices, like the S&P 500 or the Dow Jones Industrial Average. Dividend Aristocrats are all in the S&P 500, which implies a certain level of quality. On the date of publication, Thomas Niel did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines. Best of all, you can activate Portfolio Protection at any time to protect your gains and reduce your losses, no matter what industry you invest in.

5 Top Dividend Stocks to Buy in May 2023 – The Motley Fool

5 Top Dividend Stocks to Buy in May 2023.

Posted: Wed, 26 Apr 2023 07:00:00 GMT [source]

The variable component fluctuates based on the company’s free cash flow. Cumulatively, Coterra shareholders took home $2.49 per share in 2022 dividend payments. Over the past five years, cash dividends for CAT stock have increased by an average of 9% annually. This trend could continue, given both the stock’s low payout ratio (22.64%), along with the company’s continued reporting of strong results. For the last quarter, Caterpillar reported $4.91 in adjusted earnings per share.

Automatic Data Processing (ADP)

It’s latest increase – upping the quarterly dividend by a penny to $1.08 per share – was announced in August 2022. Happily for shareholders, the sudden and sharp downturn couldn’t stop SYY from hiking its dividend for a 53rd consecutive year. The company last raised its payout in April 2022 with a 4.3% bump to 49 cents per share per quarter.

This is a select group of companies that have increased their dividend for at least 25 consecutive years. As of July 1, 2022, there are only 63 stocks on this list which can make it easier to narrow down a search. Companies that are paying dividends are generally in mature industries. That means, compared to growth stocks, these stocks tend to have a lower percentage growth in revenue and earnings. This may make their share price less attractive when the economy is going well.

In terms of the dividend, the company pays an annual dividend of $2.61 per share which equates to a high-yield of 7%. With hundreds of millions of vehicles in the U.S., the country is car crazed and someone has to sell the parts to keep all those autos on the road, a market worth about $300 billion annually. Robert Kalman, cofounder and senior portfolio manager at Miramar Capital, thinks Advance Auto Parts is in a good position. The current dividend yield is more than 4%, he notes, and the company also has $1.3 billion left in its stock repurchase plan, which should help bolster share prices. Here are some dividend-paying stocks and ETFs that independent financial advisors Forbes has been in touch with suggested as ones they particularly liked. We think Pfizer stock is worth $48 per share; the stock currently trades about 14% below that.

While dividend yield compares dividend income with stock price, the payout ratio compares dividend income with company earnings. In other words, it shows investors how much a company pays them versus how much it keeps for itself. It can provide an idea of the income investors may expect to receive in the future. A payout ratio that is too high—where the company pays investors much more than it reinvests in itself—can mean there’s not much room for dividend growth. Happily for the income-minded, Grainger has achieved annual dividend growth for a half century and maintains a below-average payout ratio. It renewed its Dividend Aristocrats membership card in April 2022 when it announced a 6.2% increase in the quarterly payout to $1.72 per share.

This could enable the company to raise its payout again, much as it’s done over the preceding 16 years. Once earnings growth returns, WSM may be in a position to grow the dividend in line with the stock’s average annual dividend growth over the past five years (15.2%). You calculate dividend yield by dividing the annual dividend amount by the stock’s share price.

True, the Dividend Aristocrats index likewise finished the year in the red, but it held up far better than the broader market. 2023 has been a pretty decent year for equities, in the first quarter equities on average delivered gains and quarter 2 started off on a similar note. The SPDR S&P 500 Trust ETF (SPY) posted a gain of 1.60% in April and is up 9.19% year-to-date. Vanguard’s High Dividend Yield ETF (VYM) posted a gain of 1.27% in April but is still down 0.57% year-to-date. My watchlist managed to perform a little better in April, adding 1.91%, and it is doing just fine on the year, up 8.34% year-to-date.

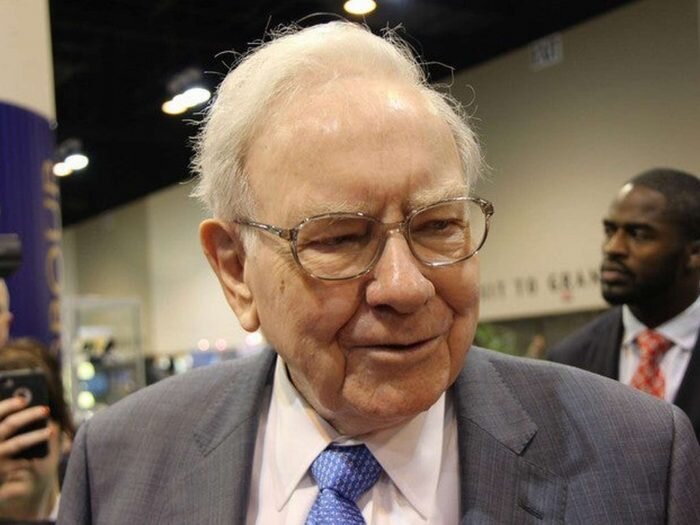

3 High-Yield Dividend Stocks You Probably Didn’t Know Warren … – The Motley Fool

3 High-Yield Dividend Stocks You Probably Didn’t Know Warren ….

Posted: Wed, 17 May 2023 09:50:00 GMT [source]

That’s thanks in no small part to 31 consecutive years of dividend increases. ECL’s most recent hike came in December 2022, with a 4% increase in the quarterly payment to 53 cents per share. In 2022, Regions raised its quarterly dividend payment from $0.17 to $0.20.

Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. These members of the S&P 500 have increased their dividends for 25 straight years. The Dividend Aristocrat list is updated annually, effective after the close of business on the last day of January. That’s not to say a Dividend Aristocrat couldn’t skip an increase or lower its dividend.

- There are simply too many market forces that can move them up or down over days or weeks, many of which have nothing to do with the underlying business itself.

- However, some may not have raised consistently but have paid dividends for a long duration and raised them only periodically.

- Chevron is a multinational energy company and the second-largest direct descendant of Standard Oil.

- The top 10 list is off to a great start this year and is making up for a lackluster showing in 2022.

- In 2022, Regions raised its quarterly dividend payment from $0.17 to $0.20.

Year-to-date SPY is performing better but the margin of difference is not significant. REITs, as an example, are required to distribute at least 90% of their income to maintain their tax status. We will also remove any names where the revenue growth (over the past five years) has been negative. Next, we will remove any stock that has an HG-Quality Score of less than 60. This check will remove three entries (BAX, AMH, INVH) from the list, leaving us 33 names.

Aflac last raised its payout in November 2022, upping the quarterly distribution by 5% to 42 cents per share. And in addition to regular dividend increases, Aflac buys back a lot of its own stock. In 2022 alone, the company repurchased 39.2 million of its common shares for $2.4 billion. If you’re considering investing your cash savings in dividend stocks, it may be tempting to compare dividend yields to the APY

PY

in your savings account. This isn’t an apples-to-apples comparison, because dividend stocks return value to you in two ways—the dividend plus share price appreciation. As well, the high cash yields we’re seeing today won’t be around forever.

The company is reviewing its businesses and reallocating capital to more attractive growth opportunities, such as electric transmission and distribution infrastructure. Bischof adds that the company’s dividend policy to pay out 60% to 70% of earnings is appropriate, and we expect the balance sheet to remain sound. Duke Energy stock is modestly undervalued, trading just 5% below our $105 fair value estimate.

Bristol-Myers Squibb is a pharmaceutical company with a market cap of $161 Billion. The company has a great portfolio of products that https://business-oppurtunities.com/the-network-marketing-success-system/ are in high demand, plus they have a strong pipeline. Buying shares today would also earn you a very high dividend yield of 8.1%.