While Liquidity Ratios measure a company’s ability to pay off short-term obligations (accounts payable), solvency ratios measure a company’s ability to pay off long-term obligations (debt). The quick ratio is a more stringent variation of the current ratio, including only the most liquid assets – or more specifically, assets that can be converted into cash within 90 days with a high degree of certainty. Liquidity ratios are simple yet powerful financial metrics that provide insight into a company’s ability to meet its short-term obligations promptly. They offer a quick snapshot of the liquidity position, aiding stakeholders in assessing financial stability, resilience, and making informed decisions.

Current ratio

High liquidity ratios indicate that a firm’s liquid assets exceed its short-term debt. Low ratios signal that it doesn’t have sufficient funds to cover its obligations without raising external capital. Liquidity ratios are important indicators of a firm’s short-term financial health. They reveal its ability to convert assets into cash quickly to cover current debts without raising external capital.

Acid-test Ratio, also known as the Quick Ratio

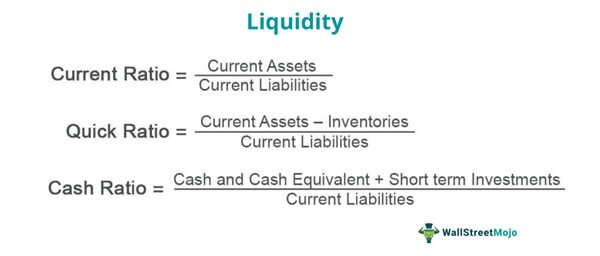

The current Ratio compares current assets to current liabilities to measure whether short-term resources are sufficient. The quick Ratio takes a more conservative approach by only considering the most liquid current assets. Tracking these ratios over time and comparing them to industry peers allows for meaningful analysis of trends and relative financial strength. The current liquidity ratio reflects the company’s ability to cover its short-term obligations by comparing the total current assets to the total current liabilities from a firm’s Balance Sheet. While the Current Ratio is a better measure of short-term debt obligations, the Liquidity Ratio provides more insight into a company’s ability to cover long-term debt and other financial commitments.

Article 6 Composition of the Liquidity Buffer

Commonly used liquidity ratios include the current Ratio, Quick Ratio, and cash ratio. The current Ratio measures a company’s current assets against its current liabilities. Current assets include cash, marketable securities, accounts receivable, and inventories. Current liabilities consist of short-term debt, accounts payable, and other obligations due within one year.

Example of Using Liquidity Ratios

By contrast, a current ratio below 1 is a red flag that a firm can be quickly rendered unable to pay its bills and pushed into insolvency. Liquidity is a measurement of a company’s ability to pay its current liabilities. A company with high liquidity can pay its short-term bills as they come due. It’s of the credit going to have a more difficult time paying short-term bills if it has low liquidity. The cash ratio is most commonly used as a measure of a company’s liquidity. This metric shows the company’s ability to pay all current liabilities immediately without having to sell or liquidate other assets.

A good indicator that your acid-test ratio is high is if two times your assets are equal to or greater than your current liabilities. For example, suppose there are not enough liquid assets in the business to purchase inventory needed for the next month’s sales. In that case, it will have to delay purchases until more liquidity is available. While liquidity is about short-term cash management, solvency evaluates long-term balance sheet stability. A company is solvent but faces temporary liquidity issues due to poor working capital management. On the other hand, it is possible for a company to be liquid but highly leveraged, threatening its solvency.

The market regulators although welcome this new technological advancement but are still keeping a tight leash. This can be owing to the contradicting and inconclusive evidence of its implications and impact on market microstructure. This study focuses on liquidity which is an integral part of a thriving stock market. We aim to examine if there is a statistical significance between volume of algorithmic orders and market capitalization.

Note as well that close to half of non-current assets consist of intangible assets (such as goodwill and patents). Though a company’s financial health can’t simply boil down to a single number, liquidity ratios can simplify the process of evaluating how a company is doing. Credit institutions shall apply the derogations provided for in paragraph 1 on an inversely proportional basis with regard to the availability of the relevant liquid assets. By tracking these ratios, management can make informed decisions on inventory management, accounts receivable collection, and accounts payable policies to improve the company’s financial health. Companies with strong liquidity ratios are considered less risky investments, as they are more likely to meet their short-term obligations and maintain financial stability during economic downturns.

- A ratio of more than 1.0 means it has enough cash on hand to pay all current liabilities and still have cash left over.

- For the purposes of this calculation, a 100% haircut shall be applied to assets that do not qualify as liquid assets.

- The credit institution shall regularly review the extent of this material deterioration in the light of what is relevant under the contracts that it has entered into and shall notify the result of its review to the competent authority.

- Comparing the company ratio with trend analysis and with industry averages will help provide more insight.

- These ratios measure a company’s financial health and indicate the ease with which it can convert assets into cash to pay off liabilities.

Credit institutions shall multiply liabilities resulting from the institution’s own operating expenses by 0%. By derogation from the first subparagraph, where the liabilities referred to in that subparagraph are covered by the UK deposit guarantee scheme or an equivalent deposit guarantee scheme in a third country they shall be multiplied by 20%. Credit institutions shall multiply by 10% other retail deposits, including that part of retail deposits not covered by Article 24, unless the conditions laid down in paragraph 2 apply. Credit institutions shall determine the composition of their liquidity buffer in accordance with the formulae laid down in Annex I to Chapter 2 of the Liquidity Coverage Ratio (CRR) Part of the PRA Rulebook. The market value of each of the level 2A assets shall be subject to a haircut of at least 15%.

However, if liquidity is interpreted more narrowly and the quick ratio is considered, the ratio is lower, but in the example it is still sufficient at 213%. The company can pay its liabilities in full within a short time without having to liquidate assets from inventories. If the current ratio is below 100%, this means that the company cannot repay its current liabilities with its current assets. However, this need not be a cause for concern, as long as this situation does not become the norm.