Contents:

The market fundamentals such as Price to Earnings ratio (P/E Ratio) is the major interest for the investors in the long-term. There are a variety of significant variations to consider between forex trading and stock trading. Forex dealers profit from this disparity in value by trading their currency strategically with international currencies. The purpose of international exchange is to buy a currency when under-priced and sell it when the value of the native currency increases. This is crucial with stocks – assessing the long-term growth, as opposed to the quick wins which may seem appealing.

It is a necessity that you know the different concepts of the https://1investing.in/ market like NSE, BSE…etc. If the stock market index is high it reflects that the economy is in strong position. On the other hand if the stock market index is low it reflects the economy is in weak position.

A classic example of trading is the basis of the stock market, where the trader buys a certain number of stocks when the prices are low and sells them when the prices are high to generate huge profits. This time approach not only allows the traders to make quick transactions but also earn more compared to the long-term investors. Trading is a short-term and volatile process that involves frequent transactions based on the trends in the market. It is relatively short compared to long-term transactions such as mutual funds or bonds. Common examples of trading are stocks, commodities, currencies , or other financial instruments. Suppose the long-term investors earn 10-15% of the profit annually; a trader can earn the same 10-15% monthly depending upon the choices and decisions of the trader.

Is cross currency trading allowed in India?

The main difference between contracts is when the transaction price is determined and when the physical exchange of currency pairs takes place. The first difference lies between the trading of Stock and Forex. Stock is traded at a Stock exchange whereas Forex is traded over-the-counter. Thus, one can say that the stocks are a centralized exchange, unlike the Forex market where transactions are done privately between the buyer and the seller. To conclude, a person’s trading style, risk tolerance, and financial goals will determine whether they choose to trade FX or stocks.

Hence, investors need to do more company-specific research before a trading position. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Settlement is the process of transferring security rights, paying off dues, and/or receiving profits as a result of trading forex or stocks. The leverage that you may get to trade stocks online depends on various factors and is generally known to be lower than the leverage you get in forex trading. But the thing is, leverage in forex trading is known to be one of the highest. In India, for example, you can trade currency derivatives with more than 40x leverage for certain INR pairs.

- In the spot market, currency trading takes place at real-time exchange rates.

- The average daily volume of the forex market is around $6.6 trillion.

- We provide the best trading signals to help traders succeed in the forex market.

In fact, stocks and currencies are in many ways correlated because of the following reasons. When you make a profit or loss while trading forex derivatives in India, your profit or loss will be settled in INR. Large-caps and blue-chips may garner higher demand while small-caps and penny stocks struggle for liquidity. You use your native currency like the INR to purchase shares. The value of the shares will rise and fall only in the same currency.

How much money is traded on the Forex market daily?

If you are still deciding on whether to trade forex or stocks, it is important to approach it from the angle of which works best for you personally, rather than what is objectively more successful. Determining whether forex is better than stocks, or stocks are better than forex, is difficult to define exactly. This is because while they have similarities, forex and stocks are actually very different. Top Currency strategies before you start trading in the currency markets. Primarily, both markets are influenced by supply and demand, but there are many other factors that can cause price fluctuations.

The financial markets offer a wide range of asset classes for investment, out of which Forex and Stocks are the most popular and profitable ones. Now, both stock trading and forex trading has leverage, but forex has significantly much more of it. You should consider this as an important risk assessment factor when you decide between stock and forex. Stock prices fluctuate on the basis of financial health of the company, corporate earnings, expansion plans, etc. Overall health of the economy and the sector to which the company belongs is also important, but individual performance plays a more important role.

The first currency listed in the forex pair is the base currency, while the second currency is called the quote currency. If the trader expects the base currency to appreciate against the quote currency, he will buy the currency pair. If they expect the value of the base currency to depreciate against the quote currency, they will sell the currency pair. For instance, if the value of USD is expected to appreciate against INR, traders can buy USD/INR futures. Market Impact – While trading in stocks, you need to concentrate on the companies you are investing in, their earnings, cashflow, levels of debt, etc.

Open Free Demat Account

MUFG Research maintains a long EUR/USD and a short USD/JPY exposure in its ToTW portfolio. The short USD/JPY trade suffered today longs after the Bank of Japan left policy unchanged. European options are only exercisable at the conclusion of the agreed-upon term . It is very important for the investor to know the actual difference between Forex Trading and Stock Trading.

How to Start Stock Trading in Australia How to Start Stock Trading in … – TheBull.com.au

How to Start Stock Trading in Australia How to Start Stock Trading in ….

Posted: Thu, 27 Apr 2023 22:44:33 GMT [source]

Another important point to note is that currency derivatives in India are cash-settled. Your profits and loss in every trade will be in terms of INR – not foreign currency. Banks, large financial institutions, and even countries participate in the forex market. But lucky for retail traders like you, the currency derivatives market is a subset of the broader forex market. The forex rate or foreign exchange rate is the value of one currency in terms of another. Another way to look at this is how much of one currency you need to buy another.

The Instrument – What you are trading in signifies the major difference between stock trading and Forex trading. Forex represents a market where currencies are bought and sold, while stocks are purchased and sold in stock markets. The currency markets are the most valuable and biggest in the investment world today, and whether you choose to trade in stocks or Forex is entirely dependent on your individual requirements. The practice of purchasing and selling other currencies with the intention of making a profit is known as FOREX, sometimes known as foreign exchange or currency trading. It is the biggest financial market in the world and is open 24 hours a day, 5 days a week, with a daily transaction of almost $5 trillion.

Factors that impact the stock market

First off, you need currency to buy anything anywhere in the world. What impacts currencies may thus have an influence on the equities market. When someone says underlying, they mean the main security that forms the core of a security, portfolio, or market. By the way, the forex market is the largest market in the world by daily volume, which is close to $6 trillion. It is known to have ample liquidity but is home to some of the biggest players in the market. Furthermore, a person can exchange a pair of currencies either in the spot market or the derivative market.

Before making any investment decisions, it is crucial to carry out careful study and analysis. If necessary, you should also seek the opinion of a financial expert. Currency pairings are always traded in forex trading, with one currency’s value expressed in terms of another currency.

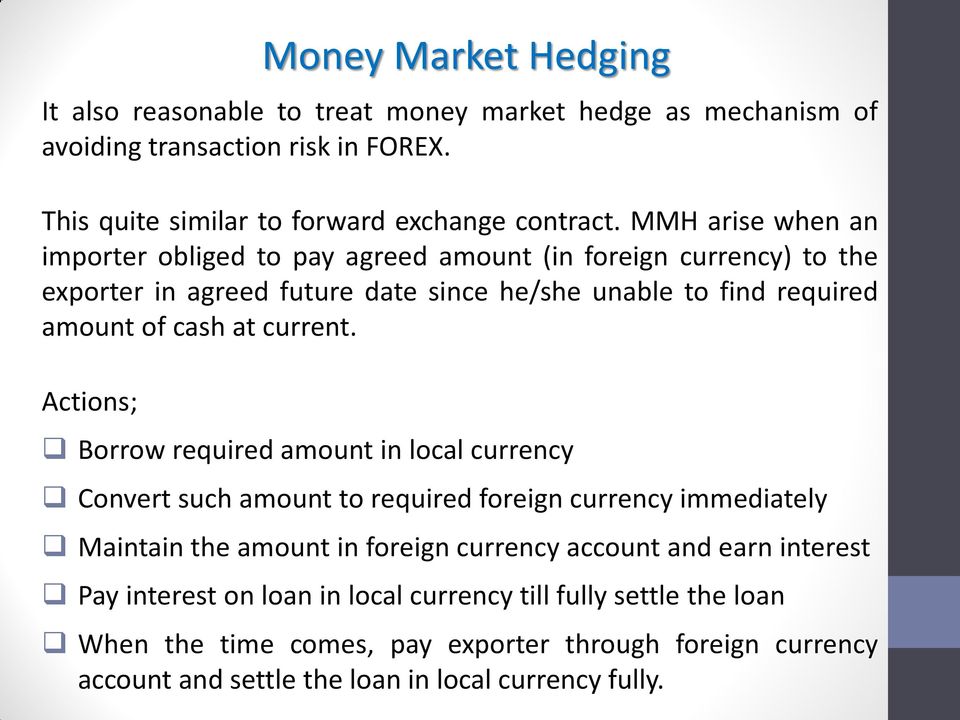

Factors leading to a gap include- big news, major financial breakthroughs, and economic/global catastrophes. A currency futures is a forward agreement that allows exchanging one currency for another at a future date at a specified purchase price. Spot FX contracts deliver the underlying currency immediately from the settlement date.

Stocks vs Forex: What’s The Difference? – Capital.com

Stocks vs Forex: What’s The Difference?.

Posted: Thu, 13 Apr 2023 14:40:46 GMT [source]

Traditionally, assets like currency and stocks have been among the most popular assets and have played an important role in the development of major market economies. A “gap” occurs when the opening price is higher than the last session’s high, known as the gap up, or lower than the previous session’s low, known as the gap down. These gaps can be significant for trading as there are usually traders who believe the gaps will be closed relatively quickly. And this allows forex traders to make possible profits as they can better predict the possible short-term direction of the price.

There is a difference in time involved in both the market-based money investments. A classic example of “investing” is mutual funds and involves lesser risk and lesser profit. Other examples are bonds or baskets of stocks for long holding positions.

Forex Vs Stocks in 2022

principle of indemnity definition and how it workss and forex can both be dangerous investment options, but they also have the potential to be profitable. Before making an investment in any choice, it’s crucial to conduct extensive research and have a sound investment plan. The Currencies section gives access to over 2,000 currency pairs from India and around the world. To use this section, begin by choosing the geographic location of the currency you seek.

- This way you can buy stocks and earn dividends without needing to monitor or maintain your portfolio, or make any quick decisions.

- Her goal is to help readers make better investment decisions.

- Let’s learn more about them in order to understand them better as investment options.

- Stocks, on the other hand, involve purchasing and selling shares of corporations that are publicly traded.

- First off, you need currency to buy anything anywhere in the world.

Furthermore, the stock market is equity-settled as well as cash-settled. Equity-settled means shares are delivered to the demat account of the buyer. The primary participants of the forex market are forex brokers, commercial banks, legitimate dealers, and currency authorities. While participants may own their trading centers, it is essential to note that the market is spread globally. There are multiple markets in which participants can trade, with close and continuous communication between trading venues.

Meanwhile, the forex market remains active almost 24 hours a day in different parts of the world, with trading time in India being 9 am to 5 pm. In the forex market, the major factors that affect currency prices are those related to the economy, such as inflation, interest rates, gross domestic product growth, current account deficit, etc. So, investors need to focus and research more on the macroeconomic situation of the country. It is important for an investor to know that trading in the foreign exchange market is vastly different from trading in the stock market, even though both are components of the financial market.

Forex vs. Stocks vs. Crypto: What Trading Option Is Best for Me? – ABC 10 News San Diego KGTV

Forex vs. Stocks vs. Crypto: What Trading Option Is Best for Me?.

Posted: Fri, 28 Apr 2023 17:30:00 GMT [source]

Before you indulge in either , there are distinctions and similarities that may help you in your trading activity and define your strategy and appetite for risk. Although the share market seems to be a great rescue, you can always make profits through stock tips, bank nifty tips, and stock options tips. The prominent question is “stocks or Forex” which one to choose. To make a choice, one should know what distinguishes these two. Short-term hedges of spot FX or foreign stock market positions are one of the most prevalent uses of FX options.