Content

- What is the normal balance for the asset, expense, and owner’s drawings accounts?

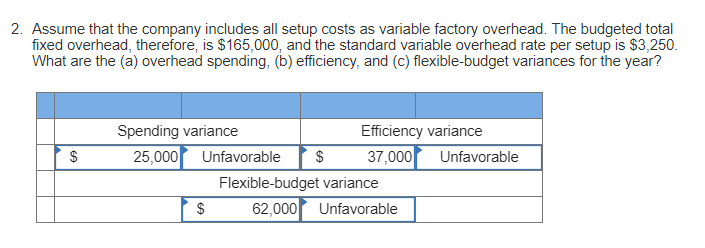

- Is There an Easy Way to Remember Normal Balances for Accounts?

- Recording Account Payable – Examples

- Record a Customer Payment on a Previous Credit Sale

- Accounting Principles I

- Step 1: Accounts having debit balances

- Accounting: What the Numbers Mean

Liabilities normally carry a credit balance while assets carry a debit balance. Expenses carry a debit balance while incomes carry a credit balance. The concept can be explained using two accounting equations. Journal entries are created in accounting systems to record financial transactions. Debits and credits must be recorded in a certain order in an accounting journal entry. Debits and credits in an accounting journal will always appear in columns next to one another.

- The first step is to determine the type of accounts being adjusted and whether they have a debit or credit normal balance.

- A business may incur these debts for a variety of reasons.

- In accounting, account balances are adjusted by recording transactions.

- When analyzing a company’s turnover ratio, it is important to do so in the context of its peers in the same industry.

- Paying out a Dividend or an Owner’s Withdrawal decreases Equity.

If the percentage is high, buyers pay their credit card vendors on time. Suppliers may be pushing for faster payments, or the firm may be trying to take advantage of early payment incentives or raise its creditworthiness if the figure is high. The types of accounts what is normal balance lying on the left side of these equations carry a debit balance while those on the right-side carry a credit balance. Each account type has a normal balance. That normal balance is what determines whether to debit or credit an account in an accounting transaction.

What is the normal balance for the asset, expense, and owner’s drawings accounts?

Thus, if the entry under the balance column is 1,200, this reflects a debit balance. If it appears as , then this is a credit balance. As mentioned, normal balances can either be credit or debit balances, depending on the account type. A contra account contains a normal balance that is the reverse of the normal balance for that class of account. The contra accounts noted in the preceding table are usually set up as reserve accounts against declines in the usual balance in the accounts with which they are paired. For example, upon the receipt of $1,000 cash, a journal entry would include a debit of $1,000 to the cash account in the balance sheet, because cash is increasing.

What are the 2 types of normal balance?

A normal balance is the expectation that a particular type of account will have either a debit or a credit balance based on its classification within the chart of accounts.

As assets and expenses increase on the debit side, their normal balance is a debit. Dividends paid to shareholders also have a normal balance that is a debit entry. Since liabilities, equity , and revenues increase with a credit, their “normal” balance is a credit. Table 1.1 shows the normal balances and increases for each account type.

Is There an Easy Way to Remember Normal Balances for Accounts?

Every transaction that happens in a business has an impact on the owner’s Equity, their value in the business. If an account has aNormal Debit Balance, we’d expect that balance to appear in theDebit side of a column. If an account has aNormal Credit Balance, we’d expect that balance to appear in theCredit side of a column. The key to understanding how accounting works is to understand the concept of Normal Balances. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- Because of the impact on Equity , we assign a Normal Debit Balance.

- Business transactions completed by Hannah Venedict during the month of September are as follows.

- Let’s take a closer look at what these terms mean and how they work together in the accounting system.

- When a company earns profits, it is recorded as a credit to the equity account, and when the company incurs losses, it is recorded as a debit to the equity account.

- A debit is a feature found in all double-entry accounting systems.

It is part of double-entry book-keeping technique. A journal entry was incorrectly recorded in the wrong account. TREASURY STOCK is stock reacquired by the issuing company and available for retirement or resale. It is issued but not outstanding.

Recording Account Payable – Examples

The suppliers are independent persons willing to give the company credit to purchase the raw materials. Any growth in the account payable account would be recorded as the credit in the account payables. In contrast, any drop in the account payable account would be reflected as a debit in the account payables. On the balance sheet, liabilities include any items that represent debts owed by the company to third parties, such as financial institutions or suppliers. They can be current liabilities such as accounts payable and accruals, or long-term liabilities such as bonds payable or mortgages payable. After a month has passed, XYZ Company makes a repayment to LMN and QPR Companies for the purchase made above.